July PPI Data Reveals Broadening Inflationary Momentum

American wholesale prices experienced their steepest monthly climb in over three years during July 2025, as the Producer Price Index for final demand jumped 0.9% – a dramatic acceleration from the modest 0.2% increase economists had projected. This represents the most significant single-month surge since June 2022, pushing the annual wholesale inflation rate to 3.3%, up sharply from June’s 2.4% reading.

The data marks a critical juncture in the inflation narrative, suggesting that businesses may finally be transitioning from absorbing elevated costs to transferring them downstream in the supply chain.

Service Sector Leads Price Acceleration

The inflation surge was predominantly fueled by services sector pricing, which climbed 1.1% – the fastest pace recorded since March 2022. This broad-based expansion across service categories accounted for approximately 75% of the overall increase, with wholesale trade margins for machinery and equipment distribution spiking 3.8%.

The goods component contributed through a 0.7% advance, largely attributed to agricultural commodity volatility. Fresh and dry vegetable prices skyrocketed 38.9%, while meat products and energy derivatives including diesel fuel (up 11.8%) and jet fuel added to the pricing momentum.

Financial Markets Recalibrate Policy Expectations

The unexpected inflation intensity immediately altered market sentiment, prompting traders to reassess their Federal Reserve policy projections. Equity markets retreated from recent highs as the S&P 500 declined following the release, reflecting diminished confidence in aggressive monetary easing scenarios.

International Market Divergence Emerges

Global trading floors exhibited contrasting responses to inflationary headwinds. Indian equity indices demonstrated remarkable resilience, with the Sensex advancing 304 points to 80,539.91 and the Nifty 50 climbing 131.95 points to 24,619.35 during Tuesday’s session. This strength reflected India’s contrasting inflation trajectory, with retail prices rising just 1.55% annually in July – a multi-year low.

Conversely, US equity futures indicated cautious opening sentiment, suggesting investors were reassessing the sustainability of recent record-breaking performance across major indices.

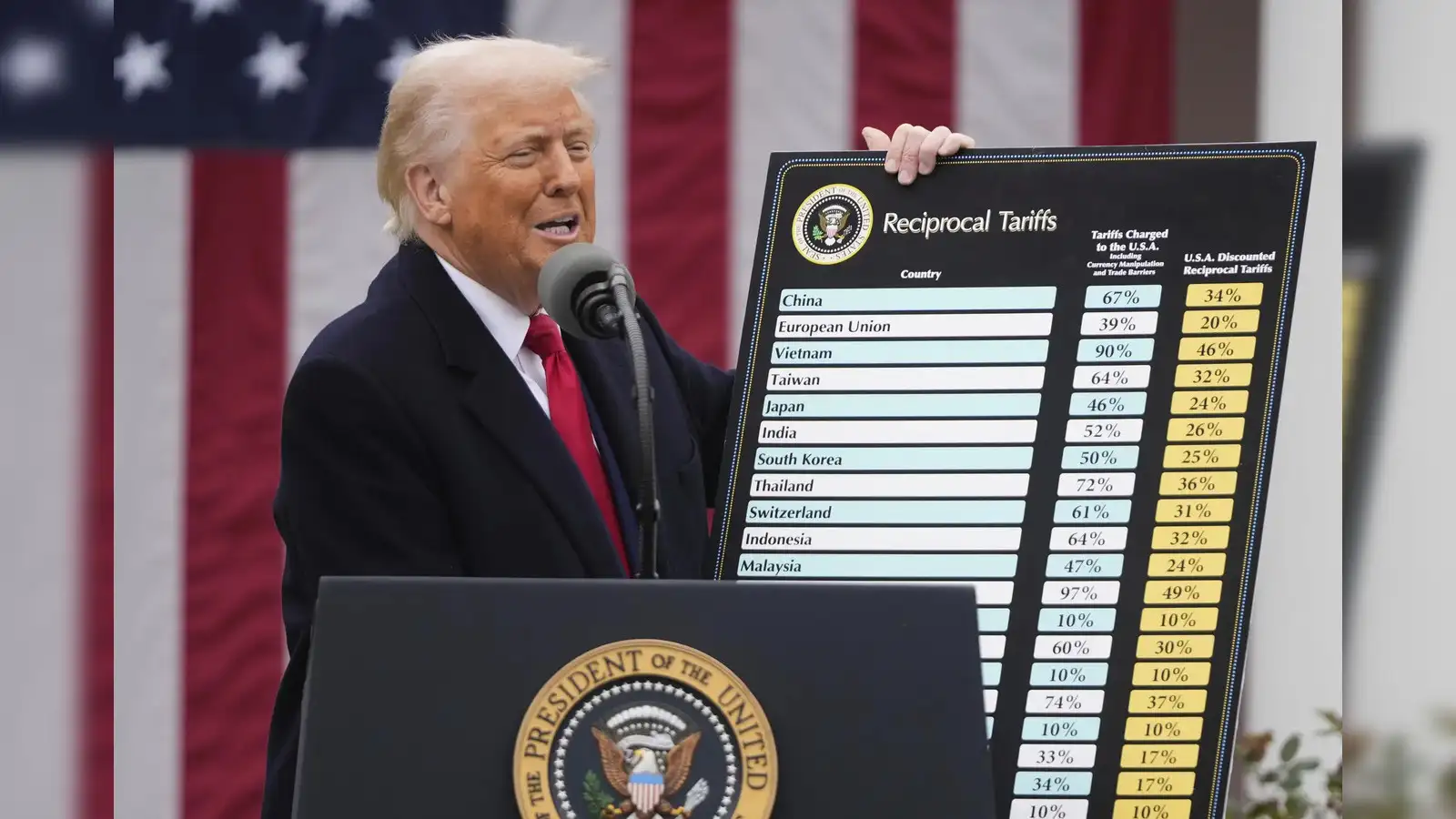

Trade Policy Consequences Materialize

The July acceleration potentially signals a fundamental shift in corporate pricing strategies following months of cost absorption related to expanded trade restrictions. Companies that had previously maintained margins through operational efficiency may now be compelled to implement price adjustments to preserve profitability.

Core PPI metrics, excluding volatile food and energy components, advanced 0.6% monthly – the largest increase since March 2022. The annual core rate expanded to 2.8% from 2.5%, indicating persistent underlying price pressures beyond temporary supply disruptions.

Central Bank Policy Implications

Federal Reserve officials now confront a more complex decision matrix as they evaluate monetary policy adjustments against emerging price dynamics. The wholesale inflation acceleration challenges previous assumptions about the temporary nature of recent price pressures, particularly those linked to international trade policies.

Market-based rate cut expectations have moderated following the data release, with traders reducing bets on aggressive policy accommodation. The broad-based nature of price increases across both manufacturing and service sectors suggests inflationary forces may possess greater persistence than previously anticipated.

Economic Outlook Considerations

The wholesale price surge introduces new variables into economic forecasting models, as producer-level inflation often precedes consumer price adjustments. The comprehensive scope of July’s increases – spanning goods, services, and geographic regions – indicates potential momentum that could influence broader economic conditions.

Financial analysts are monitoring whether this development represents an isolated monthly fluctuation or the emergence of a sustained inflationary cycle that could reshape policy expectations and market valuations through the remainder of 2025. The intersection of trade policy impacts and domestic demand conditions creates a unique set of circumstances requiring careful economic navigation.